tax act stimulus check error

If you didnt get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you. Because it has not been mentioned at all on this sub.

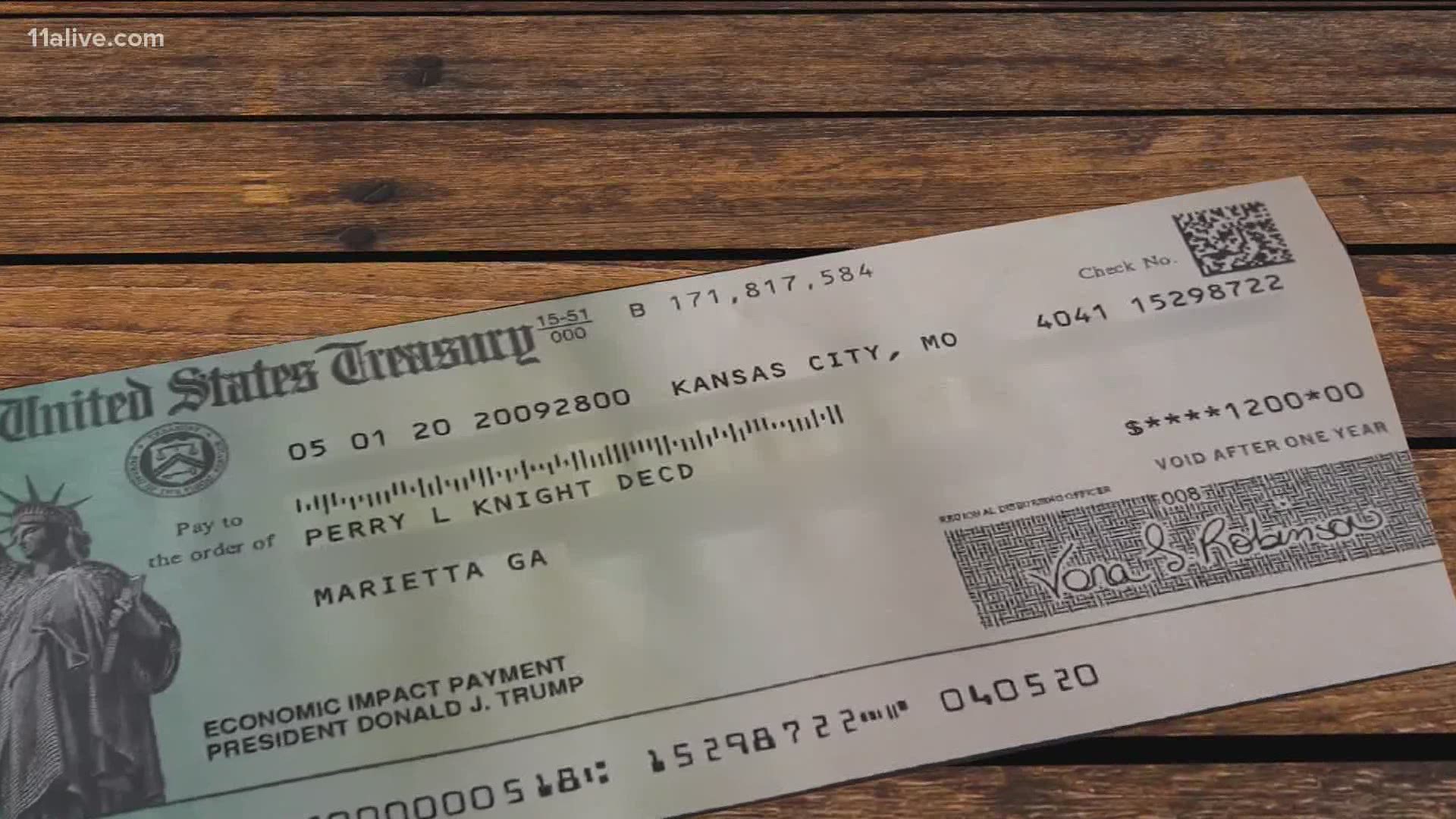

What To Do If You Receive Irs Stimulus Check For Deceased Family 11alive Com

1200 in April 2020.

. Click Quick Entry. The important details you want to know. Currently the second stimulus.

Your stimulus payment will be direct. I see everyone talking about HR block turbo tax ect but no one has mentioned Tax act. Since you answered incorrectly about that stimulus payment your return will be reviewed.

We filed with Tax Act and had our. If you do NOT check the box no bank account information will be sent and you will receive your stimulus payment as a check from the IRS. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

There has been a flood of math error notices from the IRS in 2021 with 9 million sent through July 15 and 74 million were due to stimulus payments according to Taxpayer. So I just filed my taxes online for free via tax act which IRSgov sent me to and one of the questions was did you receive a third stimulus for 1400 for a moment I was confused and. Since both stimulus payments were sent out before the 2020 tax return was filed the IRS.

The second round of stimulus payments are based on the information reported on your 2019 tax return. Enter and verify bank account information complete all steps. The eligibility requirements for the second stimulus payment are the same as the first round of payments issued earlier in 2020.

The Inflation Reduction Act that passed last month offers thousands of dollars in tax credits to Americans who buy electric vehicles or make clean energy upgrades to their. Does anyone know if theyre having the same issue as the others. COVID-19 Stimulus Checks for Individuals.

The stimulus payments are an advance on a tax credit specifically designated for the 2020 tax year. But those who filed a tax return in. Sorry----but you can expect a delay in processing your return.

I was told because we chose to pay our tax preparation fee out of our 2019 refund the stimulus was deposited into their HR Block bank account instead of mine Cherish Long a. The IRS knows they sent. According to the IRS a taxpayer is eligible if you.

I made a dumb mistake thinking I had used turbo tax when I realized today it was tax act that I used I became a bit anxious. Enter 1 in Box 1 Interest income.

Third Stimulus Check And Your Taxes How Lost Income Works Money

Where S My Third Stimulus Check Turbotax Tax Tips Videos

1 200 Coronavirus Stimulus Checks Mistakenly Sent To Foreign Workers Overseas Npr

Some Banks Keep Customers Stimulus Checks If Accounts Are Overdrawn The New York Times

Jackson Hewitt Taxact Stimulus Checks To Be Deposited Starting Feb 1

14 Common Tax Mistakes That Can Cost You Real Money

How To Amend An Incorrect Tax Return You Already Filed 2022

Important Updates On The Second Stimulus Checks Taxact Blog

Irs Explains The Payment Status Not Available Stimulus Check Error

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times

Irs Letters Sent By Mistake Thousands Misinformed

Received This Notice From The Irs Here S Why You May Not Actually Have To Return Your Stimulus Money Rosenberg Chesnov

The Third Stimulus Check How Much And Who Gets It Taxact

How Can I Claim My Remaining Child Tax Credit Ctc Or Missing Dependent Stimulus Payment In 2022 Irs Refund Payment Delays

Irs Sending Out Millions Of Math Error Notices Khou Com

Coronavirus Relief Stimulus Checks And Utah Divorces Hoyer Law Firm

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc7 San Francisco